Introduction

Xero is a popular cloud-based accounting software that helps small and medium-sized businesses manage their finances, such as cash flow, accounts, and expenses. Many businesses also use Employment Hero for their HR needs alongside Xero for accounting. While some businesses prefer Xero’s payroll functions, others might find Employment Hero Payroll more suitable, especially for more complex payroll requirements.

Combining Employment Hero Payroll and Xero Accounting

For businesses with simple payroll needs, Xero Payroll is sufficient. However, it’s designed primarily for smaller businesses. As your business grows, particularly if you surpass 100 employees, Xero Payroll can become costlier, and you might need a different payroll solution when you reach 200 employees. Xero Accounting is essential for small and medium businesses in Australia.

For businesses with complex payroll needs, integrating Employment Hero Payroll with Xero Accounts can be beneficial. This integration allows your Chart of Accounts to be pushed into Xero either as a manual journal or accounts payable invoice. Multiple entities can maintain multiple Employment Hero Payroll accounts to keep the Chart of Accounts organized. Australia’s complex employment law and payroll system add to the challenge, making it crucial to ensure compliance with payroll tax, Single Touch Payroll (STP), and Modern Awards.

Advantages of Employment Hero Payroll

By using a fully integrated HR and payroll platform like Employment Hero, you can automate many payroll processes. This reduces double data handling, minimizes errors, and ensures you never lose a timesheet or leave request again. Automating award interpretation is particularly crucial in Australia, where modern awards are complex and frequently updated. Employment Hero Payroll includes over 50 predefined awards and allows you to create dynamic rule sets to streamline pay runs.

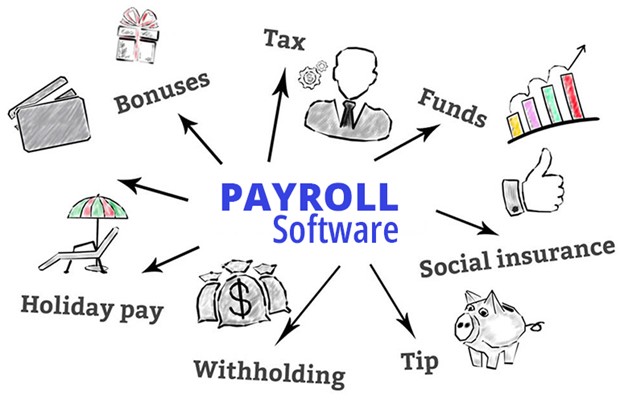

Some Key features of Employment Hero Payroll:

- Onboarding

– Save countless hours onboarding new hires and focus on other important HR tasks.

– Employment Hero reduces the time it takes to onboard new employees from three days to three hours by automating onboarding tasks and customizing the flow for each team. - Compliance

– Employment Hero HR platform ensures compliance with all national employment standards and labour laws.

– The platform’s HR documents and policies are maintained by a team of lawyers to keep them up-to-date, reducing compliance errors and risks. - Award Interpretation

– Employment Hero Payroll includes over 50 built-in modern awards, crucial in Australia where interpreting awards is complex but essential.

– It automatically allocates the appropriate entitlements for overtime, work types, and more based on submitted timesheets, helping you comply with changing award provisions, minimum shift rulings, and other entitlements. - Rostering

– Employers can create and reuse roster templates for different locations or work types.

– Employees can accept, decline, or bid on shifts, and employers can manage staffing budgets to avoid overstaffing. This automation reduces errors and ensures compliance with employment laws. - Time and Attendance

– Employees can log their start, end, and break times using a self-serve kiosk, from their phones, iPad or tablets.

– This information can be automatically converted into timesheets for the next pay run, eliminating the need to chase timesheets. This automation minimizes errors and ensures accurate payroll processing. - Cost Centres and Work Types

– For businesses with multiple locations, cost centres help track where operational costs occur and the types of work performed.

– Employment Hero Payroll ensures employees are paid correctly when switching between different types of work with different entitlements, ensuring compliance with employment laws. - Self-Service Superannuation

– Employment Hero captures new employees’ superannuation details during onboarding and syncs them with the payroll system.

– Employees can update their superannuation details via their employee files, with changes automatically reflected in the payroll. - Support for Rapid Growth

– Employment Hero automates admin tasks, supporting rapid-growth companies and moving towards a paperless workplace.

– It frees up time for more valuable tasks, helping your business grow.

Conclusion:

Hand in hand, they stand, not either/or, but together, charting accounts with grace, keeping them neat forever.

Xero Accounting is essential for Australian small and medium businesses, but Employment Hero Payroll may better suit those managing diverse employees. Integrating both syncs your Chart of Accounts into Xero, ensuring organization. Combining them offers a comprehensive solution for efficient accounting and payroll management.

Credits

Vigneshkumar Muthiah, Services Management Team