Effectively managing finances is an essential yet intricate component of any business, particularly for law firms, which face distinct challenges in financial management. The complexities associated with trust accounting, stringent compliance requirements, and the necessity for precise financial reporting can be particularly demanding for legal professionals with limited time. This is where specialized legal bookkeeping services prove invaluable.

Legal Bookkeeping Services:

Law firm bookkeeping entails the management of financial records and transactions that are unique to legal practices. In contrast to general bookkeeping, it requires adherence to specific responsibilities, including trust accounting compliance, legal billing, and the management of client funds. A legal bookkeeper is tasked with the responsibility of accurately monitoring these funds and ensuring appropriate reporting practices are followed.

The primary responsibilities associated with bookkeeping for law firms include:

- Ensuring the accuracy of invoices for legal services.

- Administering client trust accounts

- Overseeing Company Expenditures

- Ensuring the preparation of precise financial statements.

- Ensuring timely and precise invoicing for clients.

- Managing documentation and procedural workflows

- Managing employee payroll

Distinctions in Bookkeeping Services for Legal Practices:

General bookkeeping entails the systematic tracking of a business’s financial transactions, encompassing income, expenses, payroll, and taxes. The primary objective is to maintain precise financial records, which facilitate effective cash flow management, tax preparation, and the generation of reports that support informed decision-making.

Legal bookkeeping encompasses all aspects of general bookkeeping while also addressing the specific needs of law firms and legal practices. This requires strict adherence to regulations imposed by legal governing bodies and ensuring compliance with relevant laws, such as the Legal Profession Uniform Law Framework. Although both types of bookkeeping share a common foundation, legal bookkeeping involves a greater level of complexity.

The Importance of Specialized Bookkeeping Services for Law Firms:

Law firms must adhere to stringent guidelines when managing client funds, as non-compliance can lead to significant legal ramifications. A knowledgeable legal bookkeeper with expertise in trust accounting can help ensure that your firm maintains compliance and avoids potentially substantial penalties.

Errors in financial records can result in substantial legal and tax complications, including fines and investigations. Engaging a professional legal bookkeeper can mitigate the risk of inaccuracies by ensuring that all transactions are recorded correctly and in compliance with applicable laws.

Legal professionals often have demanding schedules managing client cases and legal responsibilities. By outsourcing legal accounting services, you can concentrate on your cases while financial experts manage your accounting needs.

Key Attributes of Effective Legal Bookkeeping Services:

One of the key qualifications for a law firm bookkeeper is expertise in trust accounting and compliance. It is essential that the bookkeeper possesses a thorough understanding of the legal requirements related to client trust accounts and is skilled in managing these accounts in strict adherence to pertinent regulations.

An important aspect to consider is the integration with legal billing software. It is essential that your bookkeeper is well-versed in the billing systems typically utilized within law firms. This familiarity will help ensure that invoicing, payments, and financial records are managed accurately and efficiently.

A reputable bookkeeping service will offer regular financial reporting and cash flow management, enabling you to continuously monitor the financial health of your organization and make informed decisions accordingly. Furthermore, it is essential for your bookkeeper to ensure the secure management of sensitive client information, particularly in the legal sector, where the protection of confidential client data is paramount.

Benefits of Engaging External Legal Bookkeeping Services:

One of the primary benefits of choosing outsourced legal bookkeeping is its cost-effectiveness. Engaging an in-house bookkeeper can be financially burdensome, particularly for small to mid-sized firms. Outsourcing provides the opportunity to access the expertise of qualified professionals at a significantly lower expense. By utilizing an outsourced service, you benefit from specialists who possess a deep understanding of the intricacies of legal financial management.

Additionally, outsourced bookkeeping services offer scalability. As your firm expands, you may require more sophisticated financial services. A reputable outsourced bookkeeping provider can adjust to meet your evolving needs without the challenges associated with hiring additional personnel.

Selecting the Appropriate Legal Bookkeeping Service:

When selecting a legal bookkeeping service, it is important to inquire about their experience working with law firms. Industry expertise is essential, as a bookkeeper familiar with legal accounting will possess a deeper understanding of the unique challenges and compliance requirements that your firm encounters.

Be sure to ask pertinent questions regarding their approach to trust accounting, financial reporting, and compliance. Additionally, watch for any potential red flags, such as a lack of transparency or an unwillingness to discuss their methods or technologies. The significance of industry experience cannot be emphasized enough. A provider experienced in legal bookkeeping will be more adept at ensuring your firm remains compliant and financially stable. Opt for a service that employs the latest technology to guarantee that your records are securely maintained and easily accessible. By collaborating with experts, you can minimize risks, save time, and concentrate on delivering exceptional legal services. Outsourcing to a specialized provider of legal accounting services will help ensure that your law firm remains compliant, efficient, and financially sound.

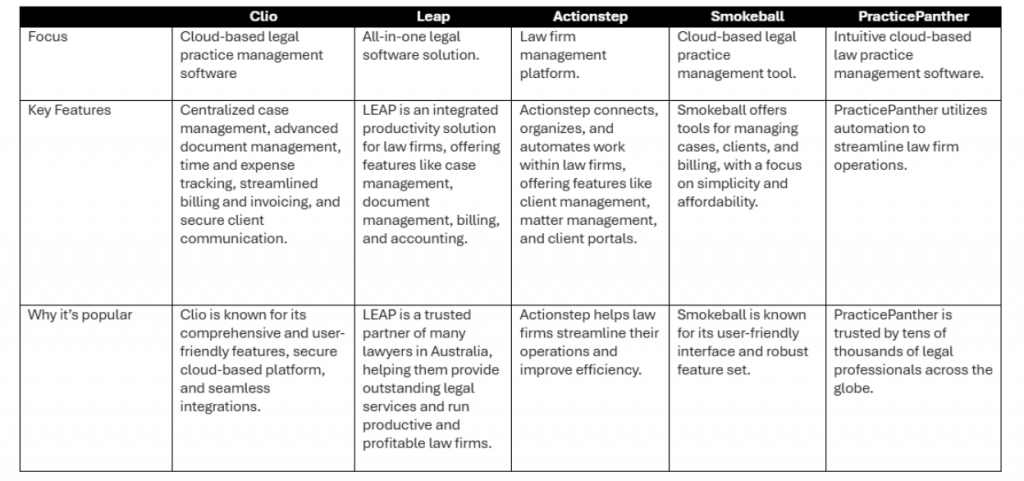

Software Comparison for Law Firms:

Credits

Naveen A, Services Management Team