New criminal underpayment laws have been introduced in some countries, including Australia, to tackle wage theft and ensure that workers are paid fairly. These laws make it a criminal offense for employers to underpay employees intentionally or through negligence, with significant penalties for those found guilty.

For example, in Australia, the Fair Work Legislation Amendment (Secure Jobs, Better Pay) Act 2022 introduced these criminal penalties for employers who intentionally or recklessly underpay workers. Employers can face hefty fines or even jail time if they deliberately underpay employees, and this includes not just salary but also penalties for unpaid superannuation contributions and leave entitlements.

This move is aimed at improving workplace fairness and deterring employers from exploiting their workers.

Effective January 1, 2025, knowingly underpaying an employee’s wages or entitlements may be classified as a criminal offense, excluding instances of genuine error.

We are authorized to investigate any suspected criminal underpayment offenses and may refer appropriate cases for criminal prosecution. A conviction could result in penalties, including fines, imprisonment, or a combination of both.

To help businesses mitigate the risk of criminal prosecution, protective measures are available. These include the Voluntary Small Business Wage Compliance Code and cooperation agreements.

CODE :

We are unable to refer the conduct of a small business employer for potential criminal prosecution if we are confident that they have adhered to the Code concerning any instances of underpayment.

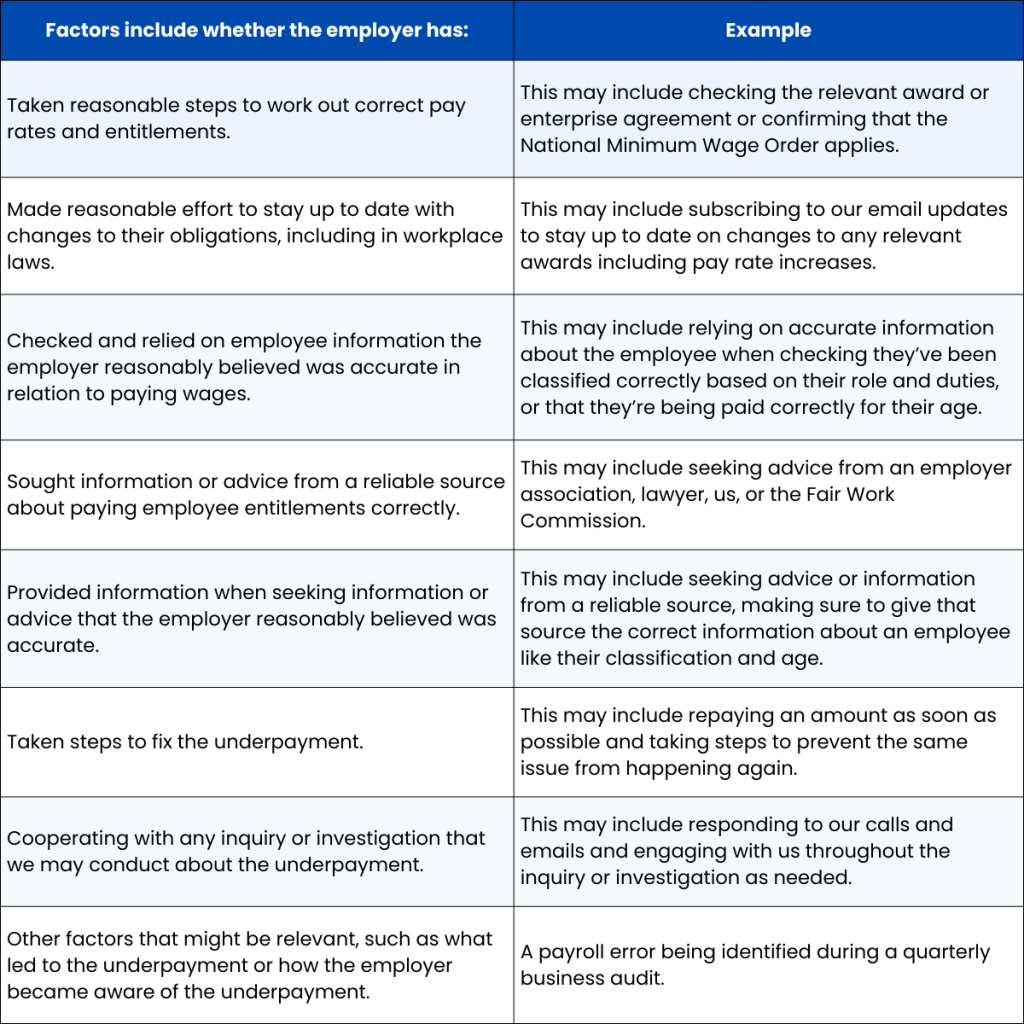

A small business employer is deemed to be in compliance with the Code if there is no intention to underpay their employees. This will be evaluated by examining various factors. These factors are familiar to compliant employers; rather, they represent steps that many already implement as part of effective business practices.

Businesses of all sizes can utilize the Code and its accompanying guide to ensure timely and accurate employee compensation and to promptly address any issues that may arise.

Cooperation Agreements:

Cooperation agreements offer protection against potential criminal prosecution in cases where conduct may constitute a potential offense or related offense. We will evaluate the decision to enter into a cooperation agreement based on the following criteria:

The specific details and nature of your disclosure related to the conduct

- The extent to which you have provided a voluntary, candid, and thorough disclosure of the relevant conduct

- Your level of cooperation with our inquiries regarding the conduct

- Our evaluation of your commitment to ongoing cooperation, including the provision of detailed information that will allow us to assess the effectiveness of your actions and approach to remedying the consequences of the conduct

- The nature and severity of the conduct in question

- The context in which the conduct took place

- Your history of compliance with the Fair Work Act (FW Act).

A cooperation agreement is a formal document established between the FWO and an individual, corporate entity, or Commonwealth agency. This agreement outlines specific conduct by the individual or entity that may constitute a potential offence or related offence. Additionally, the cooperation agreement incorporates provisions that mandate the individual or entity to take proactive measures to rectify the consequences of their actions and to ensure compliance in the future.

WHAT YOU CAN DO NOW : Refer to the Code and our Guide for ensuring accurate employee compensation. The Guide provides practical advice, tools, a checklist, examples, and best practice recommendations.

Credits

Naveen A, Services Management Team