Tax compliance is no longer just about lodging returns on time. Australian accounting firms today are under pressure to deliver speed, accuracy, transparency, and scalability—all while managing increasing compliance complexity. That’s where LodgeiT stands out.

Designed by accountants, for accountants, LodgeiT is an all-in-one, cloud-based tax preparation and lodgement platform built specifically for Australian tax professionals.

Why Modern Accounting Firms Need Tax Automation

Many firms still struggle with:

· Manual data entry across multiple systems

· Re-keying financial data from accounting software into tax forms

· Increased risk of errors and ATO rejections

· Inefficient workflows during peak tax seasons

Tax automation softwares like LodgeiT addresses these challenges by connecting accounting data directly to tax compliance, reducing friction and saving time.

What Is LodgeiT?

LodgeiT is a cloud-based tax software platform that enables accountants and bookkeepers to:

· Prepare and lodge a wide range of ATO forms

· Automate tax calculations and validations

· Integrate seamlessly with popular accounting systems

· Manage compliance efficiently across individuals, businesses, trusts, and SMSFs

It is one of Australia’s long-standing SBR-enabled platforms, supporting tax forms going back more than a decade—ideal for firms handling amendments and historical data.

Key Features of LodgeiT

1. Automated Tax Form Preparation

· Dynamic tax forms that auto-populate from accounting data

· Cross-filling between related entities (e.g. trusts, beneficiaries, spouses)

· Built-in validation checks to reduce errors before lodgement

2. Cloud-Based Access

· Fully cloud-hosted and Australian-based

· Automatic software updates—no manual installs

· Secure access for teams working remotely or across offices

3. Smart Calculators & Working Papers

· Depreciation, borrowing costs, capital allowances, and interest calculators

· Working papers directly linked to tax forms

· Audit-ready documentation without external spreadsheets

4. Workflow & Audit Trail Controls

· Track changes by user and date

· Clear audit trails for compliance and internal reviews

· Role-based permissions for team members

5. Integrated Document Management

· Attach supporting documents directly to tax forms

· Tag and organise files without complex folder structures

Benefits for Accounting Firms

Time & Efficiency Gains

· Eliminate double handling of data

· Reduce manual reconciliation between accounting and tax systems

· Faster turnaround during BAS and tax return seasons

Improved Accuracy & Compliance

· Automated validations help prevent incorrect submissions

· Reduced risk of ATO rejections and follow-ups

Cost-Effective Scaling

· Cloud pricing model with low entry cost

· Suitable for both small practices and high-volume firms

· Handle thousands of lodgements without system slowdowns

Better Client Experience

· Faster delivery of tax outcomes

· Support for electronic signatures

· Less back-and-forth chasing information

Key Integrations That Matter

One of LodgeiT’s strongest advantages is its broad integration ecosystem.

Accounting Software Integrations

· Xero – direct data import for financials and reports

· QuickBooks Online – seamless mapping and syncing

· MYOB AccountRight & Essentials

· Excel – flexible uploads for legacy data

ATO & SBR Integration

· Standard Business Reporting (SBR) enabled

· Direct ATO lodgement and prefill capabilities

SMSF Software Integration

· Simple Fund 360 – export SMSF annual return data directly into LodgeiT

· Ideal for firms managing SMSF compliance in-house

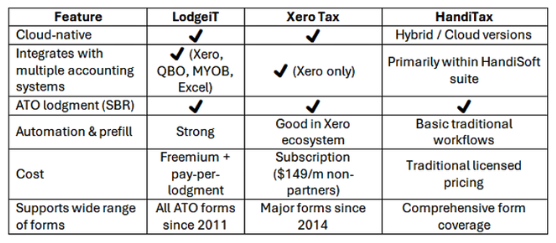

LodgeiT vs Xero Tax vs HandiTax

Is LodgeiT Right for Your Firm?

LodgeiT is particularly well-suited for:

· Small to mid-sized accounting firms

· Practices with high tax lodgement volumes

· Firms looking to reduce manual work and improve accuracy

· Teams using Xero, MYOB, QuickBooks, or SMSF software

For Australian accounting firms seeking a reliable, scalable, and accountant-designed tax software, LodgeiT delivers strong value. Its automation, integrations, and cloud-based workflow help firms move away from manual compliance and toward a more efficient, future-ready practice.

If your goal is to save time, reduce errors, and streamline tax lodgement, LodgeiT is well worth a closer look.

For More Information visit our Website

Reach out to us at biz@purplequay.com.au

Connect with us on our WhatsApp

Credits

Ahamed Azmaan M B, Services Management Team